-

Steve Hansen

Steve Hansen

You’ve secured a new project or growth opportunity. To execute on time and at the required scale, your business may need additional equipment, and quickly. This is often where the decision comes into focus: should you rent equipment for short-term flexibility, or lease it as part of a longer-term operating plan?

At Equipment Leases, Inc., we see this decision play out every day across manufacturing, medical, construction, and energy-driven businesses. Although leasing and renting are often discussed interchangeably, they are built for very different use cases. The choice affects more than monthly cost. It directly impacts cash flow, operational control, project timelines, and long-term efficiency.

This guide explains how equipment leasing and renting actually work in practice. We outline the advantages and limitations of each, clarify when one option makes more sense than the other, and address common questions we hear from CFOs and operations leaders. The goal is to help you select the structure that aligns with how your business operates today and supports responsible growth going forward.

Leasing vs. Renting Equipment, At a Glance

Feature | Renting | Leasing |

Typical Duration | Short term (days, weeks, or months) | Long term (months to several years) |

Upfront Cost | Low | Low or none |

Monthly Cost Over Time | Higher if used long term | Lower for ongoing use |

Flexibility | High | Moderate to low |

Maintenance Responsibility | Usually included by the rental provider | Often the responsibility of the lessee, depending on structure |

Best For | Temporary, seasonal, or uncertain needs | Ongoing, predictable, revenue-supporting needs |

Ownership | No | Sometimes, with purchase or buyout options |

Upgrade Options | Yes, by returning and re-renting | Yes, typically at end of lease term |

What Is Rental Equipment?

Rental equipment allows businesses to access machinery or tools on a short-term basis without committing capital to ownership or long-term financing. It is typically used for temporary projects, seasonal demand, or one-time needs where ongoing use is uncertain.

Renting minimizes upfront cash requirements and, in most cases, shifts maintenance and servicing responsibility to the rental provider. This makes it a practical option when equipment is needed quickly, used briefly, or required to bridge a gap while longer-term plans are evaluated.

Rental structures are designed for flexibility, not long-term efficiency. They work best when the duration of use is clearly defined and limited.

How Does Renting Equipment Work?

Renting equipment involves a short-term agreement between your business and a rental provider that defines how the equipment can be used and what it will cost. Rental agreements typically specify the rental period, daily or weekly rates, delivery and return logistics, and additional charges such as insurance coverage, damage waivers, or late return fees.

Before entering a rental agreement, it is important to confirm equipment availability and ensure the selected model meets the operational requirements of the project. Not all equipment is available on demand, particularly during peak seasons or for specialized applications.

Operational readiness also matters. Rental providers expect equipment to be operated by qualified personnel. Improper use or insufficient training can lead to damage, downtime, and liability exposure, all of which increase the true cost of renting beyond the stated rate.

Common types of rental equipment include:

- Earthmoving equipment such as excavators and backhoes

- Generators and temporary power units

- Aerial lifts and scissor lifts

- Select manufacturing equipment

- Lighting towers

- Forklifts and pallet jacks

- Temporary fencing and job site structures

In practice, renting is best suited for short-term needs, seasonal work, or situations where equipment use is temporary or still being evaluated before committing to a longer-term lease or purchase.

Advantages of Renting Equipment

Renting equipment can be an effective solution when needs are short term, usage is uncertain, or flexibility is the priority. For the right use case, it offers several practical advantages.

Cost-effective for short-term needs

Renting can be economical when equipment is needed for a defined and limited period. It allows businesses to preserve cash and avoid committing capital to assets that will not be used long term.

Reduced maintenance responsibility

In most rental arrangements, routine maintenance and standard repairs are handled by the rental provider. This reduces internal maintenance burden, limits unexpected repair expenses, and helps keep projects moving without added operational complexity.

Access to current equipment

Rental fleets are often refreshed regularly, which can provide access to newer models that meet current efficiency, safety, and compliance standards. This can be especially valuable for short-term projects where equipment performance matters but ownership does not.

Operational flexibility and scalability

Renting allows businesses to scale equipment usage up or down based on workload, contract size, or seasonality. Equipment can be returned when it is no longer needed, avoiding long-term commitments that may limit flexibility.

No depreciation exposure

Because the equipment is not owned, the business avoids depreciation risk and the challenge of disposing of outdated or underutilized assets. This simplifies balance sheet considerations when equipment use is temporary.

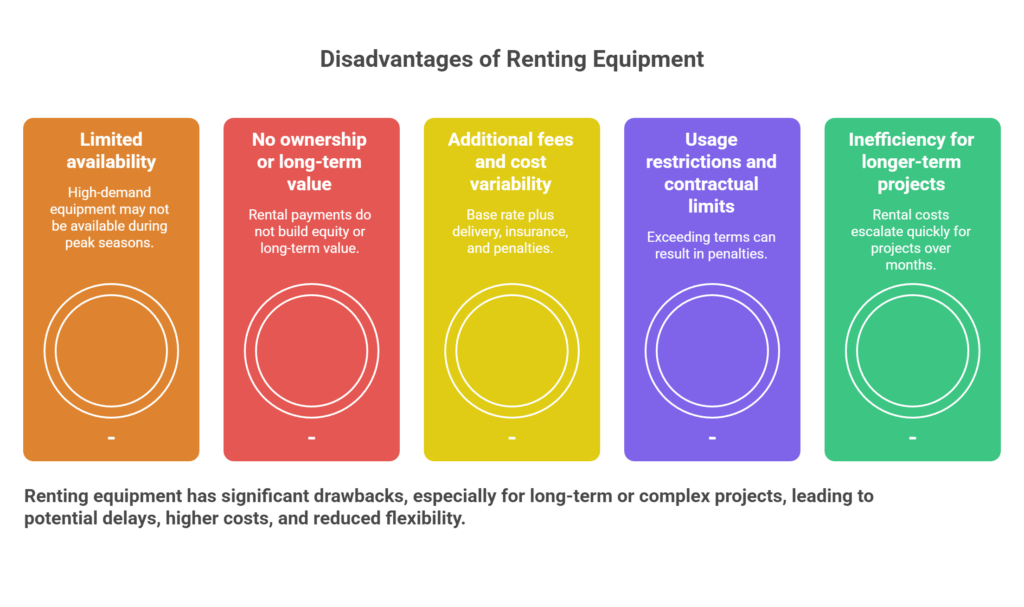

Disadvantages of Renting Equipment

While renting equipment can be effective in the right situations, it also has limitations that become more pronounced as usage extends or operational complexity increases.

Limited availability

High-demand or specialized equipment may not always be available when needed, particularly during peak seasons. This can create scheduling challenges and introduce project delays that are outside your control.

No ownership or long-term value

Rental payments do not build equity or long-term value. For businesses with recurring or ongoing equipment needs, repeated rentals can become more expensive than leasing or purchasing over time.

Additional fees and cost variability

Rental agreements often include additional charges beyond the base rate, such as delivery and pickup fees, environmental charges, insurance costs, damage waivers, or penalties for late returns. These variables can make total project costs less predictable.

Usage restrictions and contractual limits

Rental equipment is typically subject to usage limitations, operating conditions, and return requirements. Exceeding these terms can result in penalties or increased costs, reducing flexibility in real-world operating conditions.

Inefficiency for longer-term projects

Renting is generally not designed for projects that extend over several months or involve repeated use. In these cases, rental costs can escalate quickly, making leasing or financing a more efficient long-term solution.

Sample Equipment Rental Agreement Template

XYZ Rental

Equipment Rental Agreement

This Equipment Rental Agreement (“Agreement”) is entered into as of [Insert Date], by and between:

Owner:

[Insert Rental Company Name]

[Insert Address]

and

Renter:

[Insert Renter Name]

[Insert Address]

- Equipment

The owner agrees to rent to Renter the equipment listed in Exhibit A, which is attached hereto and made part of this Agreement (the “Equipment”).

- Rental Period

The rental period will begin on [Insert Start Date] and continue until [Insert End Date], unless terminated earlier as provided in this Agreement.

- Rental Rate

Renter agrees to pay the owner a rental rate of [Insert Rental Rate] per [day / week / month], due on [Insert Due Date or Payment Terms].

- Security Deposit

Renter shall pay a refundable security deposit of [Insert Amount] upon executing this Agreement. The deposit will be returned within [Insert Number of Days] after the Equipment is returned in acceptable condition, less any costs for damages or cleaning.

- Use of Equipment

Renter agrees to:

- Use the Equipment solely for its intended purpose

- Operate the Equipment safely and in accordance with the manufacturer’s guidelines

- Ensure that only qualified personnel operate the Equipment

- Maintenance and Repairs

The owner is responsible for standard maintenance and repairs due to normal wear and tear. Renter is liable for any damage resulting from misuse, negligence, or unauthorized alterations.

- Liability and Insurance

Renter assumes full responsibility for the Equipment during the rental period and shall maintain appropriate liability and property insurance coverage. Proof of coverage must be provided upon request.

- Indemnification

Renter agrees to indemnify and hold harmless Owner from any claims, losses, or damages arising from the use of the Equipment during the rental period.

- Termination

Either party may terminate this Agreement upon written notice if the other party breaches any material term. Early termination fees may apply as outlined in Exhibit B.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [Insert State].

Signatures

OWNER:

Signature: __________________________

Name: ______________________________

Title: _____________________________

Date: ______________________________

RENTER:

Signature: __________________________

Name: ______________________________

Title: _____________________________

Date: ______________________________

Exhibit A – Equipment Description

[List all equipment, including serial numbers, model numbers, and condition notes.]

Exhibit B – Additional Terms or Fees (if applicable)

[Include early termination fees, delivery or pickup charges, or other special terms.]

What Is Leasing Equipment?

Leasing equipment allows your business to use the machinery, vehicles, or technology you need without purchasing it outright. It is designed for situations where equipment plays an ongoing role in operations and is expected to deliver value over time.

For many businesses in manufacturing, medical, construction, and energy, leasing provides access to high-value equipment while preserving cash and avoiding large upfront costs. Payments are structured over a defined term, making expenses predictable and easier to plan for.

When you lease equipment, you enter into an agreement with a financing partner, such as Equipment Leases, Inc., that gives you the right to use the equipment in exchange for consistent payments. The goal is alignment, matching the cost of the equipment to how long and how intensively your business uses it, so you can operate, grow, and budget with confidence.

How Equipment Leasing Works

An equipment lease is structured around how your business plans to use the equipment and how long it is expected to remain productive. The process begins with identifying the equipment, confirming pricing with the vendor, and determining the appropriate lease term.

Lease terms typically range from 24 to 72 months, depending on the type of equipment, its useful life, and your operational needs. Payments are set on a predictable schedule, often monthly, which helps with budgeting and cash flow planning.

Lease agreements also define responsibilities such as:

- Maintenance and repairs, which may be included or handled by your business depending on the structure

- Insurance coverage, usually required to protect against damage, loss, or liability

- End-of-term options, which may include returning the equipment, extending the lease, or purchasing it

At the end of the lease, you are not locked into a single outcome. The structure is designed to give you flexibility based on whether the equipment is still valuable to your operations or ready to be replaced.

Well-structured equipment leases are built to support long-term use, preserve cash, and align payments with the value the equipment delivers over time.

Learn more about our equipment financing programs

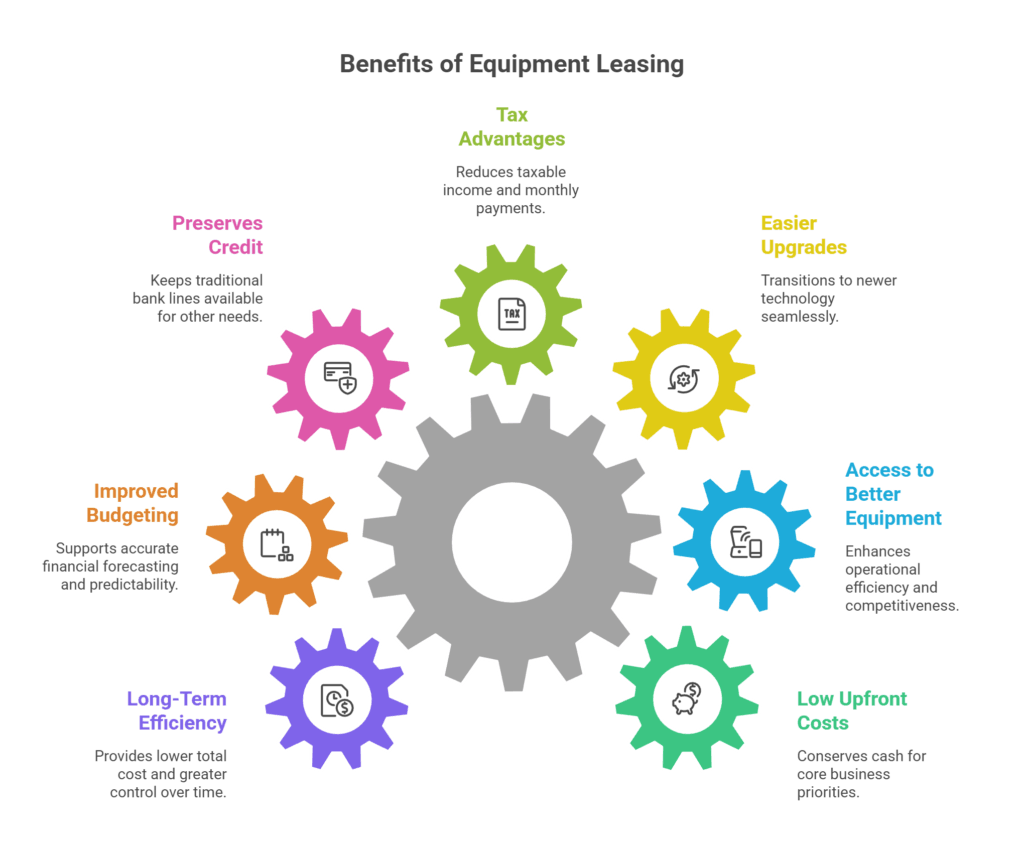

Key Benefits of Leasing Equipment

Leasing is designed to support ongoing operations, preserve liquidity, and align equipment costs with long-term business use. When structured correctly, it offers several practical advantages over renting or purchasing outright.

Low or No Upfront Costs

Unlike purchasing equipment, most leases require little to no upfront payment. This allows businesses to conserve cash and working capital for core priorities such as payroll, inventory, or growth initiatives, rather than tying up capital in equipment purchases.

Access to Better Equipment

Leasing enables businesses to acquire higher-value, more advanced equipment than they might otherwise purchase outright. This helps maintain operational efficiency, improve output, and stay competitive without absorbing the full cost of ownership.

Easier Equipment Upgrades

Lease structures typically include defined end-of-term options. When equipment becomes outdated or less efficient, businesses can transition to newer technology rather than continuing to operate aging assets. This is especially valuable in industries where equipment evolves quickly, such as medical imaging, diagnostics, automation, and advanced manufacturing.

Potential Tax Advantages

In many cases, lease payments may be treated as a business expense, which can reduce taxable income. Certain lease structures may also allow depreciation benefits to remain with the lessor, contributing to lower monthly payments.

Tax treatment varies by structure and jurisdiction, so businesses should always consult their CPA or tax advisor to determine what applies.

Preserves Credit and Cash Flow

Leasing helps keep traditional bank lines and working capital available for other needs. This flexibility can be critical for growing businesses, companies managing seasonal cycles, or organizations balancing multiple capital priorities.

Improved Budgeting and Predictability

Lease payments are typically fixed and known in advance, which supports more accurate budgeting and financial forecasting. This predictability reduces surprises and helps align equipment costs with revenue over time.

Leasing Is Better Than Renting for Long-Term Needs

Renting works well for short-term or one-time use. When equipment is needed consistently or over an extended period, leasing is usually more efficient. Over time, leasing provides lower total cost, greater control, and a structure that supports long-term operations rather than temporary access.

The Hidden Cost of Renting Equipment for Too Long

Renting equipment often starts as a practical solution. It provides speed and flexibility when timelines are tight or needs are uncertain. The challenge emerges when short-term rentals quietly extend into months of continued use.

Over time, ongoing rental payments can erode cash flow without building any long-term value. There is no equity, no ownership path, and limited control over availability or customization. What initially feels flexible can become one of the most expensive ways to keep critical equipment in service.

In many cases, prolonged renting is not a strategic choice, but a delayed financing decision. The business needs the equipment, operations depend on it, and revenue is being generated, yet the structure has not been adjusted to reflect that reality. Recognizing when a rental has crossed that threshold is key. At that point, transitioning to a lease often restores cost efficiency, planning visibility, and operational control without disrupting momentum.

Disadvantages of Leasing Equipment

While equipment leasing offers clear advantages, it is not the right solution for every situation. Businesses should understand the potential limitations and evaluate whether a lease aligns with their operational timeline and financial strategy.

No Ownership During the Lease Term

With most lease structures, your business does not own the equipment while the lease is in effect. This means the equipment typically cannot be treated as an owned asset, used as collateral, or sold to generate liquidity unless a purchase option is exercised at the end of the term.

Higher Cost for Very Long-Term Use

Leasing is designed to align cost with use over a defined period. If equipment is expected to remain in service for a decade or longer, purchasing or financing ownership may be more economical over the long run. In these cases, leasing can result in higher total cost compared to ownership-based structures.

Credit and Financial Review Requirements

Larger equipment leases generally require a review of business credit, financial performance, and cash flow. While partners like Equipment Leases, Inc. work with a wide range of credit profiles, terms and structures vary based on financial strength, operating history, and deal complexity.

Early Termination Considerations

Lease agreements are structured around an expected term. While some leases offer flexibility, others include penalties for early termination if the equipment is no longer needed or a project ends sooner than planned. Reviewing these provisions up front is critical to avoiding unexpected costs.

Maintenance Responsibilities May Vary

Depending on the lease structure, maintenance and service may be included or may remain the responsibility of the business using the equipment. For equipment with significant upkeep requirements, this should be factored into the total cost and operational planning.

Sample Equipment Operating Lease Agreement Template

The following template is provided for general reference only and is not intended as legal advice. Always consult a qualified legal professional before drafting or signing any binding agreement.

[Insert Company Name]

Equipment Lease Agreement

This Equipment Lease Agreement (“Agreement”) is made and entered into as of [Insert Date], by and between:

Lessor:

[Insert Lessor Name]

and

Lessee:

[Insert Lessee Name]

- Lease Term

The lease term shall be for [Insert Length of Lease], commencing on [Insert Commencement Date] and ending on [Insert Expiration Date].

- Equipment

The equipment to be leased is [Insert Equipment Description], as detailed in Exhibit A, which is attached hereto and incorporated by reference.

- Rent

Lessee shall pay rent in the amount of [Insert Rent Amount] per month, due on [Insert Payment Due Date] of each month during the lease term.

- Maintenance and Repairs

Lessee is responsible for maintaining the equipment in good working order and for handling any necessary repairs or replacements, except as otherwise specified in this Agreement.

- Insurance

Lessee shall provide and maintain insurance coverage on the equipment in the amount of [Insert Insurance Amount], naming Lessor as an additional insured.

- Termination

Either party may terminate this Agreement upon [Insert Termination Notice Period] days’ written notice to the other party, subject to the terms and conditions outlined herein.

Advanced Considerations, Tax, Accounting, and Financial Planning

Beyond operational needs, leasing and renting can affect how expenses are planned, reported, and managed over time. While the specifics vary by structure and jurisdiction, understanding the general implications helps businesses make more informed decisions.

Tax Treatment Considerations

In many cases, rental payments are treated as operating expenses, which means they are typically expensed as incurred. This can be useful for short-term needs but offers limited long-term planning flexibility.

Lease payments may also be deductible as a business expense, depending on how the lease is structured. In some arrangements, depreciation benefits remain with the lessor, while in others the business using the equipment may effectively control the asset for tax purposes. The treatment depends on the lease type and how it is documented.

Because tax outcomes vary, businesses should always consult their CPA or tax advisor to determine how a specific rental or lease will be treated.

Impact on Financial Statements and Planning

From a planning perspective, renting is generally viewed as a short-term operating expense, while leasing represents a longer-term commitment aligned with the useful life of the equipment.

Leasing can support financial planning by:

- Matching equipment costs to the period in which the equipment generates revenue

- Improving predictability through fixed payment schedules

- Preserving liquidity by avoiding large upfront purchases

Renting, while flexible, can make long-term cost forecasting more difficult if equipment use extends beyond the original timeline.

Real-World Planning Example

We often see businesses start with a rental to address an immediate need, then transition to a lease once the equipment becomes essential to ongoing operations. This shift allows them to move from short-term flexibility to a more predictable cost structure that aligns with revenue and long-term planning.

The right approach depends on duration, usage, and financial priorities, not just the initial cost.

Important: Tax and accounting rules are complex and situation-specific. Always consult a qualified CPA or financial advisor before making decisions based on tax or accounting treatment.

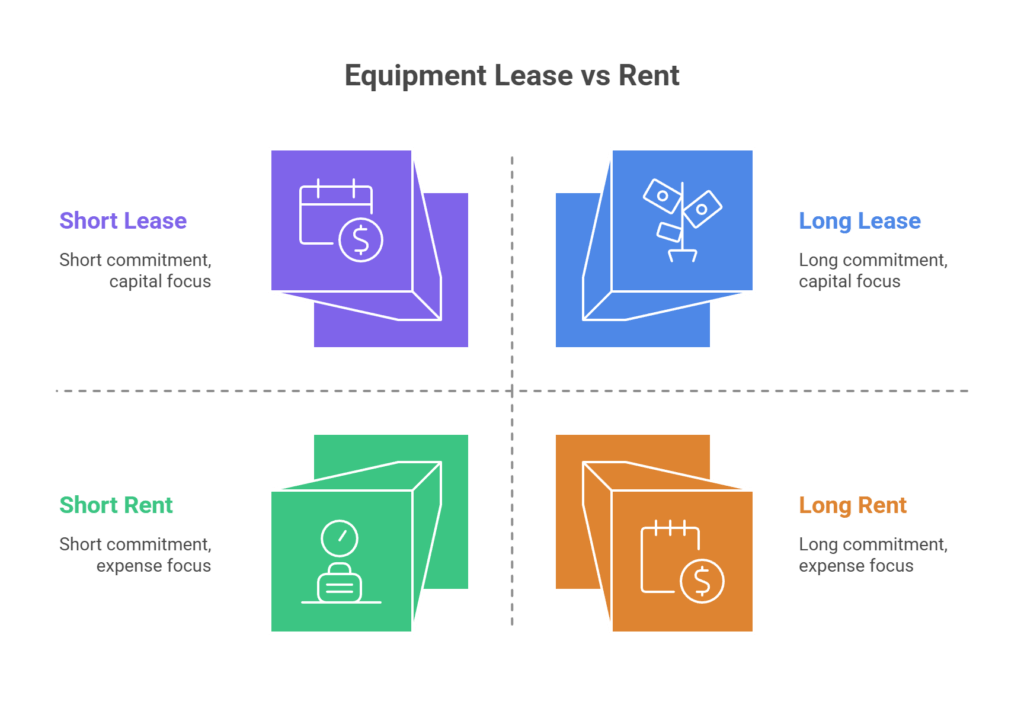

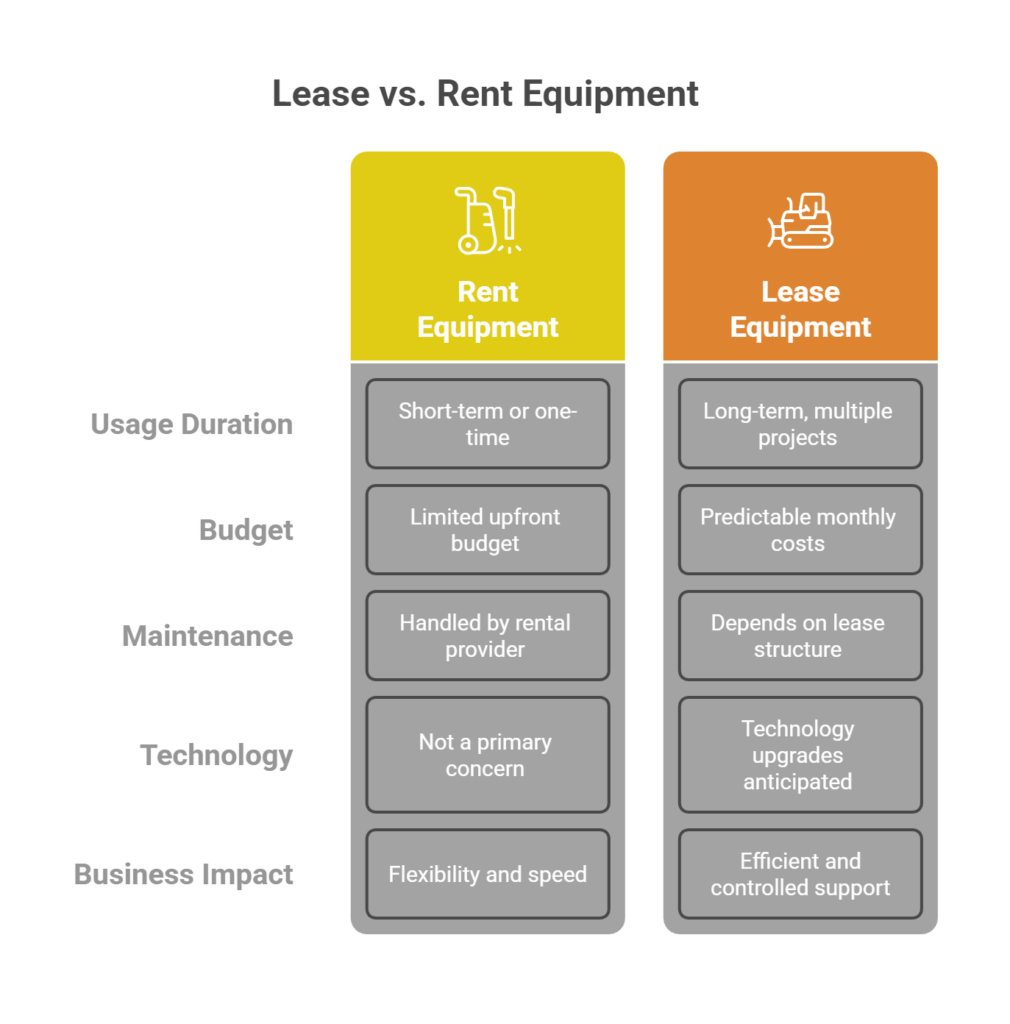

When to Lease vs. Rent Equipment

Choosing between leasing and renting depends on how long the equipment will be used and how central it is to your operations. Each option serves a different purpose.

When Should You Rent Equipment?

Renting is typically the better option when:

- The need is short term or one time, with a clearly defined end date

- Upfront budget is limited, and committing capital is not practical

- Maintenance and servicing are better handled by a rental provider to reduce operational burden

In these situations, renting offers flexibility and speed without long-term commitment.

When Should You Lease Equipment?

Leasing is generally the better choice when:

- Equipment will be used long term, across multiple projects or ongoing operations

- Predictable monthly costs are important for planning and cash flow management

- Tax treatment may allow lease payments to be deducted as a business expense, depending on structure

- Technology upgrades are anticipated, with the option to transition to newer equipment at the end of the lease term

When equipment is essential to how your business operates, leasing provides a more efficient and controlled way to support growth over time.

How to Decide: A Simple Business Checklist

If you are deciding between renting and leasing, these questions usually make the answer clear:

- How long will you realistically use the equipment?

Short-term use points toward renting. Ongoing or repeated use favors leasing. - Is the equipment critical to daily operations or revenue?

Core, revenue-generating equipment typically benefits from a lease structure. - Do you need predictable monthly costs for budgeting?

Fixed payments support planning and reduce cost variability. - Is speed the primary concern right now?

Renting can bridge an immediate need, but should not replace a long-term plan. - Will there be deposits, installation, or other soft costs involved?

These costs often change the economics and make leasing more efficient. - Will you need this equipment again after the current project ends?

Repeat use is a strong signal that leasing may be the better option.

If most of your answers point toward ongoing use and predictability, leasing is usually the more effective structure.

Find the Right Equipment Lease

Insurance Considerations

Leasing vs. Renting Equipment Insurance

Both rental and lease agreements typically require businesses to carry appropriate insurance coverage, but the expectations differ.

When renting equipment, rental providers may offer optional insurance or damage waivers. While convenient, this coverage is often limited and may not fully protect against liability, loss, or extended damage. Businesses should understand exactly what is covered and where gaps may exist.

When leasing equipment, lessees are usually required to provide proof of comprehensive insurance coverage. This commonly includes property damage and liability protection, with the lessor named as an additional insured. These requirements are intended to protect both parties over the full lease term.

In all cases, insurance terms should be reviewed carefully. Consulting with your insurance provider helps ensure coverage aligns with the agreement and adequately protects your business from risk.

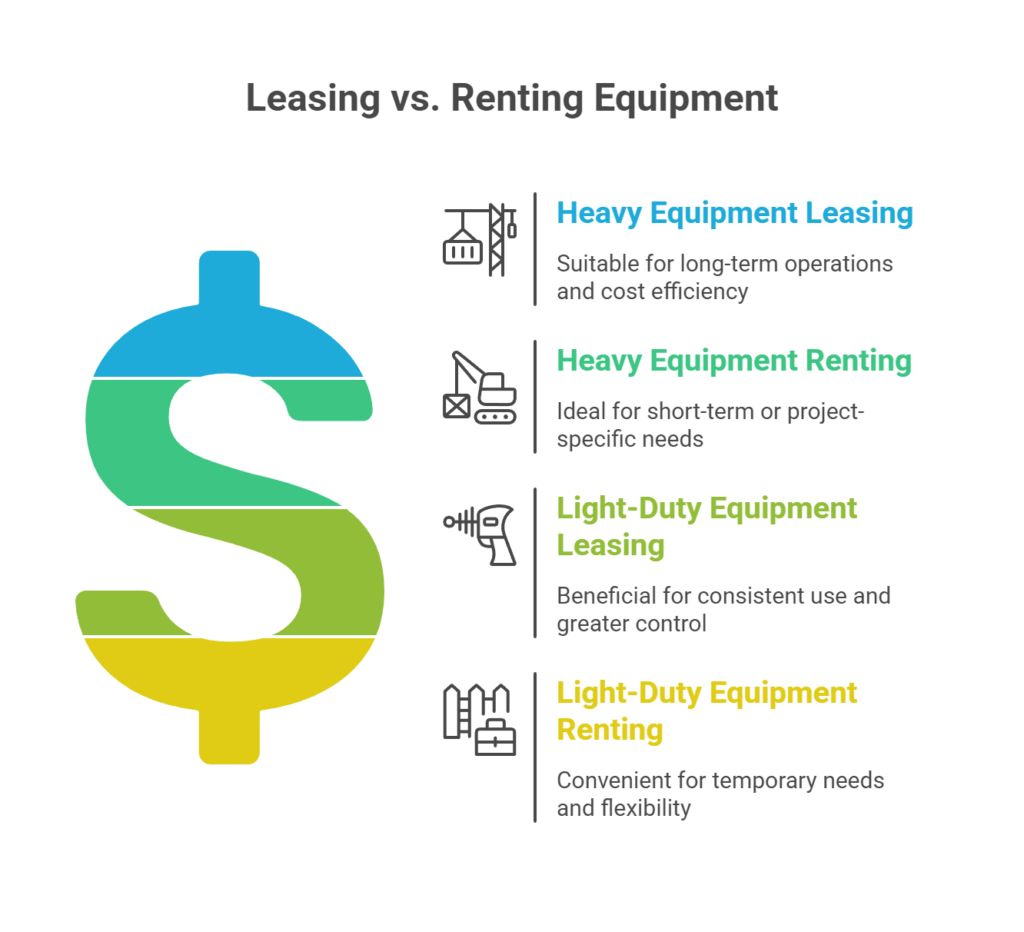

Leasing vs. Renting Heavy & Light-Duty Equipment

The decision to lease or rent often depends on the type of equipment involved and how it will be used. Heavy equipment and light-duty equipment tend to follow different cost and usage patterns.

Leasing vs. Renting Heavy Equipment

For large, capital-intensive assets, the structure you choose has a significant impact on cost and control.

Key factors to consider:

- Cost: Leasing is typically more efficient for extended use, even when maintenance is included. Renting heavy equipment can become expensive when use extends beyond a short period.

- Flexibility: Renting works well for short-term or project-based needs. Leasing requires a longer commitment but offers greater stability for ongoing operations.

- Availability: Leasing often provides better access to specific models or configurations needed for long-term production.

- Maintenance: Some lease structures include service plans, while rental terms vary by provider and usage conditions.

Lease heavy equipment when it supports long-term operations and cost efficiency. Rent when the need is short term or project-specific.

Leasing vs. Renting Light-Duty Equipment

Smaller or lower-cost equipment requires a different evaluation.

Key considerations:

- Cost: Leasing light-duty equipment may not make sense unless it will be used consistently over time.

- Maintenance: Some leases include repairs, while rental terms vary and should be reviewed carefully.

- Flexibility: Renting offers convenience for short-term needs. Leasing allows greater control and customization when equipment is used regularly.

- Insurance: Insurance requirements differ by agreement and should be confirmed before committing.

Rent light-duty equipment for temporary needs. Lease when the equipment is part of ongoing operations and better control is required.

See the types of equipment we finance across industries.

Contract vs. Agreement: What’s the Difference?

While the terms “contract” and “agreement” are often used interchangeably, they are not always the same.

An agreement is a mutual understanding between parties about their responsibilities and expectations. Not all agreements are legally binding, depending on how they are structured and documented.

A contract is a legally binding agreement that includes enforceable terms, conditions, and obligations. For equipment leasing and renting, the documents involved are almost always contracts, even if they are informally referred to as agreements.

When renting or leasing equipment, it is important to ensure the terms are clearly documented in writing. Reviewing the contract carefully, and consulting legal counsel when necessary, helps protect all parties and reduces the risk of misunderstandings or disputes later on.

Leasing vs. Renting Equipment FAQs

Is leasing cheaper than renting?

Renting can be cost-effective short term. For equipment used over months or years, leasing is typically less expensive overall, as long-term rentals often result in higher cumulative costs without long-term value.

What happens at the end of a lease?

End-of-term options vary but commonly include returning the equipment, extending the lease, upgrading, or purchasing it. The right choice depends on continued usefulness and business needs.

Do equipment leases require a down payment?

Many leases require little to no upfront payment. Costs such as delivery, installation, or soft costs may be included depending on the deal structure, equipment type, and business profile.

Who handles maintenance on leased equipment?

Maintenance responsibilities depend on the lease terms. Some agreements include service plans, while others place responsibility on the user. This should be clearly defined before signing.

Can businesses switch from renting to leasing?

Yes. Many businesses rent initially, then transition to a lease once the equipment proves essential, improving cost efficiency and long-term predictability.

Is leasing better than buying equipment?

Leasing is often preferred when preserving cash, maintaining flexibility, or upgrading technology is important. Buying may make sense for equipment expected to be used for a very long time when ownership is a priority.

Does leasing affect bank credit lines?

Leasing can help preserve traditional bank credit by providing equipment access without drawing on existing lines, which is valuable for growing businesses.

How much does it cost to lease equipment?

Lease costs vary by equipment type, industry, project size, and term length. Payments are typically monthly and structured over the period the equipment produces value, avoiding large upfront purchases.

Can leased equipment be depreciated?

Tax treatment depends on the lease structure. In some cases, lease payments are operating expenses; in others, depreciation benefits may apply. A CPA or tax advisor should be consulted.

What are the risks of leasing versus renting?

The main risk of renting is high long-term cost. The primary risk of leasing is commitment, making it important to confirm equipment needs, term length, and early termination terms.

What should I review in a lease or rental agreement?

Key items include term length, payment structure, maintenance and insurance requirements, end-of-term options, upgrade flexibility, and any fees or penalties.

Have more questions about leasing or financing equipment?

Explore our fullequipment financing FAQs or speak with a specialist to determine the right structure for your business.

Choosing the Right Equipment Strategy for Your Business

The decision to lease or rent depends on how long the equipment will be used and how central it is to your operations. Renting works best for short-term or uncertain needs. Leasing is typically the better choice when equipment supports ongoing operations and consistent revenue.

The key is alignment. Match the structure to the expected duration of use, the equipment’s importance to the business, and how costs need to be managed over time. Short-term needs require flexibility. Long-term use benefits from predictability and control.

Evaluating duration, cost, and operational impact upfront helps avoid unnecessary expense and ensures equipment decisions support growth rather than limit it.

Want to Explore Your Equipment Leasing Options?

Disclaimer:

The information provided here is for general educational purposes only. Tax laws are complex and may change. Please consult a qualified tax advisor or accountant to determine the exact implications for your business and to assist with the decision to rent or lease equipment.