Empowering Family Offices Through Equipment Financing

Save Your Cash - 100% Bonus Depreciation Year 1 - Flexible Terms - Increase liquidity - Enhance Portfolio Performance - Accelerate Growth for your Clients.

Turn capital-intensive investments into recurring cash flow & massive tax benefits.

The Challenge Most Family Offices Face

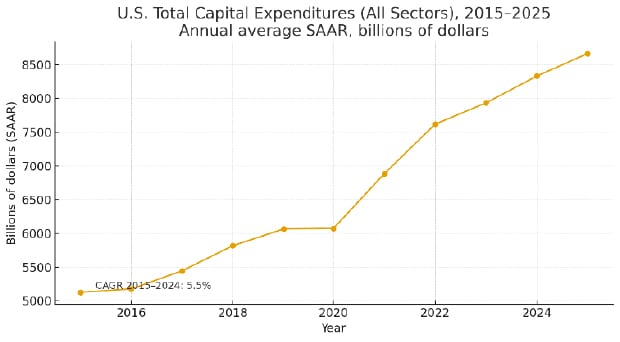

Family offices often invest in companies within capital-intensive sectors, including energy, manufacturing, food systems, and technology infrastructure. These businesses thrive on innovation but struggle with one constraint: equipment capital expenditure (CAPEX).

High upfront equipment costs can:

- Slow down expansion and technology adoption

- Tie up valuable equity or debt capacity

- Reduce portfolio flexibility and overall IRR

At Equipment Leases, we understand this issue and the implications on the bottom line. Our involvement with numerous Family Offices around the country enables them to convert large equipment purchases into structured, cash-flow-friendly financing up to $250M. Our financing solutions preserve liquidity, enhance portfolio IRR, and enable faster growth for the companies you have invested in. There are also attractive bonus depreciation available. Your investment capital should help your portfolio grow, and our capital should be used for production lines and fulfilling new orders.

Equipment Financing as a Capital Strategy with Massive Tax Benefits!

Traditional debt and equity financing can burden portfolio companies with heavy capital commitments or unnecessary dilution. An equipment loan offers an elegant alternative: the ability to deploy critical assets without tying up cash or equity. This option also opens the door to Section 179 of the IRS code, allowing for a 100% write-off in the first year for all new or used equipment purchased.

With Equipment Leases, you can:

- Preserve working capital for strategic use

- Improve balance sheet flexibility for portfolio operators

- Match equipment costs with revenue streams

- Reduce exposure to technology obsolescence

- Accelerate project deployment and ROI

By structuring each transaction around the asset’s lifecycle and the company’s financial objectives, we turn equipment into a growth enabler – not a balance-sheet constraint.

Leasing converts heavy CAPEX into manageable OPEX — freeing cash for growth while maintaining asset control.

Why Partner with EquipmentLeases.com

As a specialized equipment finance company with decades of experience in healthcare, manufacturing, and energy infrastructure, we understand how to align capital strategy with operational needs.

A partnership with us gives your family office:

- Turnkey Financing Expertise: We handle credit, underwriting, and residual value management so your team can focus on strategy.

- Client Relations –We operate as an extension of your brand. Preserving your relationships and reputation.

- Faster Deal Execution: From approval to funding in as little as 2–3 weeks.

- Customized Structures: Capital or Operating leases, or Sale-Leaseback options designed for each asset class.

- Sector Specialization: Deep experience with renewable systems, food and packaging equipment, and data infrastructure assets.

Ideal Sectors for Collaboration

Renewable Energy: BESS, Turbines, Storage, microgrid equipment.

- As a specialized equipment finance company with decades of experience in healthcare, manufacturing, and energy infrastructure, we understand how to align capital strategy with operational needs.

A partnership with us gives your family office:

- Turnkey Transaction Expertise: We handle credit, underwriting, and residual value management so your team can focus on strategy.

- Faster Deal Execution: From approval to funding in as little as 2–3 weeks.

- Customized Structures: Capital or Operating, or Sale-Leaseback options designed for each asset class.

- Sector Specialization: Deep experience with renewable systems, food and packaging equipment, and data infrastructure assets.

Food Processing & Packaging: Production lines, QA automation, cold-chain assets.

Family offices investing in food systems, manufacturing, and packaging can leverage funding for:

- Production and packaging lines

- Automation and inspection systems

- Cold-chain and logistics equipment

- Sustainable manufacturing upgrades

Why it matters: Processing and packaging facilities must be modernized constantly. Leasing enables operators to upgrade equipment without compromising liquidity or incurring excessive debt.

Data Centers & Infrastructure: Power distribution, cooling systems, UPS, server racks.

Data center development is booming, driven by AI and cloud computing. We finance:

- Power distribution and UPS systems

- Cooling, HVAC, and generators

- Networking and server infrastructure

Why it matters: These projects involve significant upfront CAPEX with recurring revenue models. Leasing spreads the cost over time and enables a technology refresh every 3–5 years, keeping infrastructure competitive.

Healthcare & Imaging: MRI, CT, and diagnostic lab automation.

Each sector demands constant reinvestment — leasing transforms that burden into opportunity.

Results & Case Studies

Medical Imaging Upgrade

Sector: Healthcare / Medical Equipment

Scenario: A family office had a portfolio company in diagnostic imaging with a major capital equipment need – specifically an MRI upgrade.

Solution: Structured a 5-year operating lease through the vendor’s lease partner, enabling the company to install the upgraded MRI suite without an upfront equity outlay or cash.

Outcomes:

- Freed up working capital for the portfolio company → able to invest in el in other growth initiatives.

- Improved IRR for the family office via OPEX-style payment stream rather than large upfront CAPEX.

- Accelerated the upgrade by enabling leasing rather than waiting for internal cash or traditional debt.

- Details – $2.4 M MRI upgrade financed in under 30-days.

Renewable Energy Storage Deployment

Sector: Renewable Energy / Infrastructure

Scenario: A family office backing a grid-scale storage / renewable developer needed to accelerate the deployment of a Battery Energy Storage System (BESS). The upfront cost was significant, tying up equity capital.

Solution: A sale-leaseback of the BESS equipment was implemented, converting the CAPEX into a lease stream and preserving the family office’s equity capital for different deployments.

Outcomes:

- Deployment accelerated by 8 months (getting early project revenues).

- The family office preserved capital for other uses rather than tying it up in heavy equipment.

- Lease payments are aligned with project cash flows rather than requiring large up-front debt or equity.

- Details – $5 M BESS financed via sale-leaseback; accelerated grid deployment by 8 months.

Food-Manufacturing Automation Upgrade

Sector: Food Processing / Manufacturing & Packaging

Scenario: A family-office-backed food manufacturing business needed to install a modern automation and inspection line (production & packaging) to meet new orders and compliance demands. The cost was large, and using cash reserves or equity would reduce flexibility.

Solution: A 5-year operating lease structure was utilized for the $3M automation line, allowing the company to upgrade immediately and match equipment costs to the production revenue ramp.

Outcomes:

- Upgraded equipment faster, enabling new orders and higher yield.

- Improved portfolio return: the family office saw an ~18% IRR improvement by converting upfront cost to a lease expense with a tailored structure.

- The business maintained working capital for other strategic uses while still modernising assets.

- Details – $3 M automation line → 5-year operating lease → ~18 % IRR improvement for family-office investors.

Data-Centre Infrastructure Refresh

Sector: Data Centres / Digital Infrastructure

Scenario: A family-office investor in a data centre business faced a large CAPEX cycle for upgrading power, cooling, UPS, and server racks to meet AI/cloud demand. While revenue was substantial, the upfront equipment cost risked tying up equity and limiting future refresh cycles.

Solution: A lease structure (operating) was implemented to enable the rapid deployment of upgrade assets, with payments spread over the asset’s life and aligned with the revenue ramp from new customers.

Outcomes:

- The infrastructure refresh was completed quickly, enabling higher-margin business (new AI workloads) sooner.

- The family office maintained liquidity to invest in other portfolio companies, rather than exhausting capital in a single, high-asset investment.

- The lease structure enabled technology refresh cycles every 3-5 years (important in data centre assets) without a full equity refresh.

- Details – $6.5M operating lease funded in less than 30-days

Why Family Offices Choose EQL

- 20+ years in mid-ticket equipment finance

- Expertise in healthcare, manufacturing, and energy sectors

- National coverage and vendor-neutral solutions

- Transparent, compliance-first underwriting

- Funding quality projects to $250M

Ready to Partner?

Schedule a confidential call to explore how Equipment Leases can integrate with your investment strategy.